unfiled tax returns reddit

I am not sure if the free file sites from IRSgov will do past years returns. How Unfiled Taxes Can Haunt You Silver Tax Group from.

Best Tax Relief Companies To Reduce Your Tax Debt Revised 2022

If you have unfiled tax returns the IRS may prepare a return for your unfiled taxes called a Substitute for Return SFR.

. You will have 90 days to file your past due tax return or file a petition in Tax Court. Dont worry they shouldnt ask you why you need the forms. If you dont have some go to IRSgov set up an account request transcripts for incomewages unmasked and account transcripts to see which returns are needed.

Unfiled Taxes Unsolved I had unfilled taxes from 2009 to 2016. Reddits home for tax geeks and taxpayers. If you have received notice.

Press J to jump to the feed. Visit your local IRS office. This return will likely result in a high tax balance.

Get all the information needed to file the past-due return. Old unfiled tax returns. There can be substantial penalties on balance-due returns.

We just mailed all the returns. Second do not try to prepare the returns yourself. Unfiled Tax Returns Reddit.

If you owe on any return file it as soon as possible. Posted by 6 years ago. Complete your tax returns accurately.

Start by requesting your wage and income transcripts from the IRS. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available. If the IRS has prepared a return for you or if you need back tax help in paying back taxes contact Austin Larson Tax Resolution for resolution of your IRS problems.

If you have old unfiled tax returns it may be tempting to believe that the IRS or state tax agency has forgotten about you. 10 years of unfiled taxes. They were recently done by a tax pro I was referred to.

In 2006 I believe I filed my last tax return. If you had a simple tax return and owed little to the IRS it might make sense but you have both rental income and expenses and investment income. How to file back tax returns 1.

Once the return is processed you will receive a notice with the balance due including penalties and interest after about 8 weeks. Failure to file penalty 5 percent per month max of 25 percent. What are the right steps to take to.

10 years of unfiled taxes. I am a bit lost here. Download the forms from the IRSs website.

7 Years of unfiled returns. Reddit iOS Reddit Android Reddit Premium About Reddit Advertise Blog Careers Press. They have forms going back to about six years.

Posted by 6 months ago. If you do neither we will proceed with our proposed assessment. Heres what to do.

Go to a local tax preparer who is experienced in helping people file back taxes. Im completely freaking out right now since that contains a shit load of sensitive information. However you may still be on the hook 10 or 20 years.

You start by collecting all your W-2s 1099s and any other income documents you have. He told me once. A day ago I had an unfiled tax return in a bag that got stolen.

Old unfiled tax returns. The deadline for claiming refunds on 2016 tax returns is April 15 2020. Total bill is about 13k.

That will immediately stop the letter flow to your house. If you fail to file your taxes by the designated deadline usually April 15 you will be assessed a late filing penalty equal to 5 of the tax due for each month it remains unpaid. This means that while you cant be put in jail for not filing a 1988 tax return you will forever owe the IRS a returnas long as you earned enough to have had an obligation to.

I dont even know if unfiled tax returns is the correct terminology but my school had been charging me Federal Tax Withholds for about 3 years for. Due to stressful personal and work relationships I kept putting off my taxes and its gotten out of hand. Address penalties and any balances owed.

Nj Couple Avoids Fbar Penalty Gets Warning Verni Tax Law

Forgot To File Taxes In 2013 And Irs Just Notified Me In 2020 R Tax

Refundtalk Where S My Refund Tax News Information

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

Unfiled Tax Returns Four Things You Must Know Youtube

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

What To Do If Your Irs Check Bounced Silver Tax Group

I Settled 27 000 In Irs Debt Dating Back To 2006 For 325 Without The Need For An Attorney R Personalfinance

The Real Reasons Why Tax Returns Are Audited Find Out The Truth Former Irs Agent Explains Youtube

Tax Lawyers Can Save Us From Double Taxation Verni Tax Law

Can The Irs Take Or Hold My Refund Yes H R Block

Is It Time For Irs Audit Protection Services Franskoviak Tax Solutions

![]()

I Didn T File 2018 Taxes What Now R Tax

Forgot To File Taxes In 2013 And Irs Just Notified Me In 2020 R Tax

Unfiled Past Due Tax Returns Faqs Irs Mind

Irs Tries To Reassure Pandemic Panicked Taxpayers

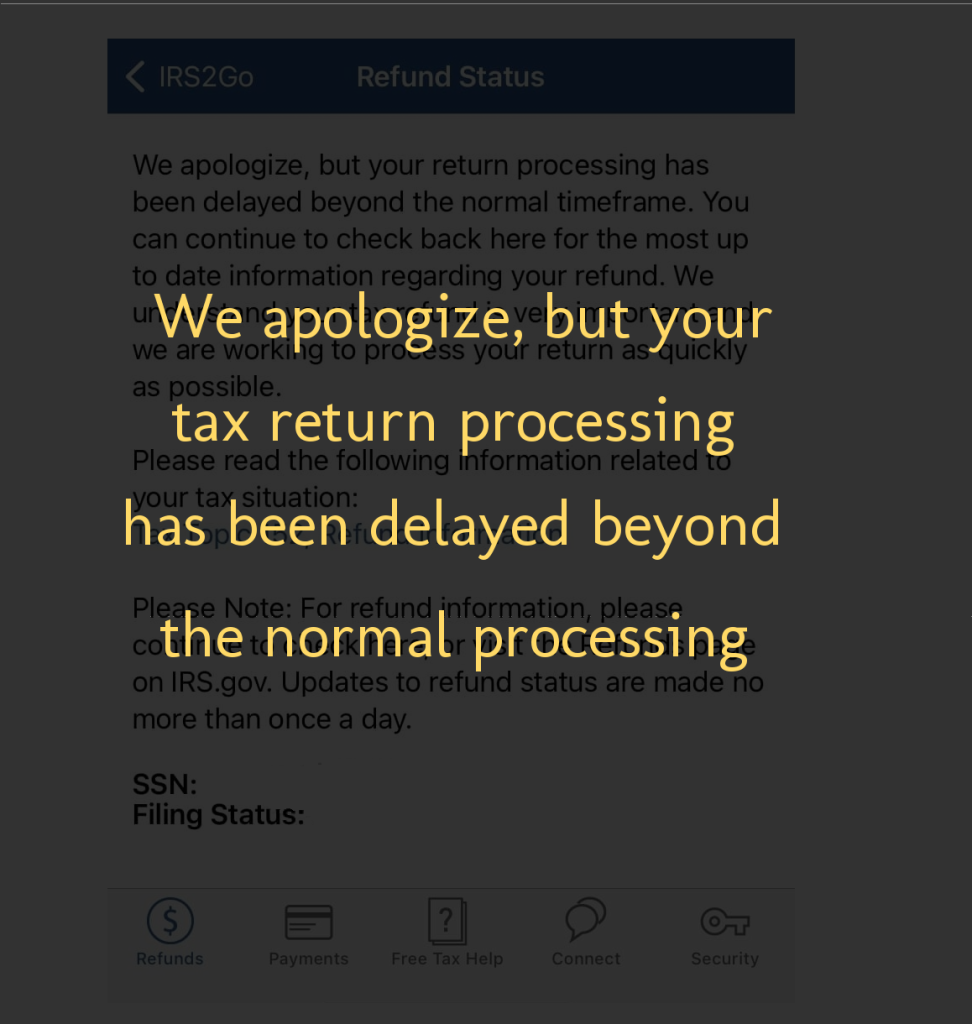

About Your Notice Where S My Refund Tax News Information

Unfiled Tax Return Information H R Block

Where S My Tax Refund 14 7 Million 2020 Returns Still In The Works Irs Says Orange County Register